Matterport Announces Record Third Quarter 2022 Financial Results

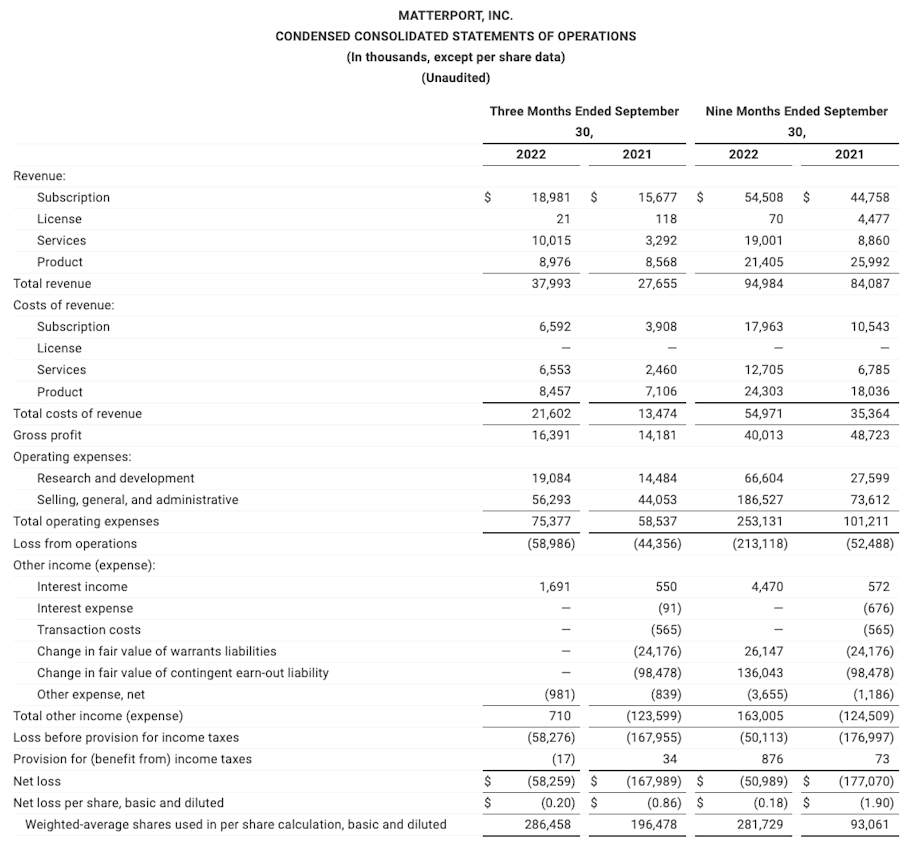

- Total revenue rose to a record $38.0 million, above Company guidance - Subscription revenue rose to a record $19.0 million, above Company guidance - Services revenue rose to a record $10.0 million, up 204% year-over-year - Q3 GAAP loss per share of

SUNNYVALE, Calif., -- Matterport, Inc. (Nasdaq: MTTR) (“Matterport” or the “Company”), the leading spatial data company driving the digital transformation of the built world, today announced record financial results for the quarter ended September 30, 2022.

“We delivered outstanding third quarter results, with record total revenue, demonstrating that our strategy is working,” said RJ Pittman, Chairman and Chief Executive Officer of Matterport. “We successfully launched our new Enterprise Essentials subscription suite as well as our new, high speed, LiDAR-enabled, Pro3 camera, which began shipping in the third quarter. We also completed the acquisition of VHT Studios, which brings together an industry-leading real estate marketing platform with Matterport’s immersive digital twin technologies. Further, customer demand remained robust in the quarter as enterprises leveraged the deflationary power of Matterport digital twins to improve operating efficiency and productivity, resulting in strong revenue growth across our target markets,” Pittman added.

“We saw strength across all of our revenue lines in the quarter, and combined with our focus on operating efficiency, we delivered financial results that exceeded our expectations on both the top and bottom lines,” said JD Fay, Chief Financial Officer of Matterport. “Subscription revenue grew to a record $19.0 million and services revenue grew 204% year-over-year, to a record $10.0 million. In addition, we were able to ship through our product order backlog during the third quarter. Finally, our focus on operational efficiency began yielding savings a quarter earlier than planned, and with our strong revenue growth, enabled non-GAAP net loss to improve by 24% sequentially, resulting in a narrower loss relative to our guidance range.”

Third Quarter 2022 Financial Highlights

Total subscribers increased to 657,000, up 50% compared to the third quarter of 2021

Spaces Under Management (SUM) grew to 8.7 million, up 40% year-over-year

Total revenue was $38.0 million, up 37% year-over-year

Subscription revenue was $19.0 million, up 21% year-over-year

Services revenue was $10.0 million, up 204% year-over-year

Annualized Recurring Revenue (ARR) exiting the third quarter was $76.0 million

Non-GAAP net loss was $0.09 per share

Recent Business Highlights

Completed the acquisition of VHT, Inc., known as VHT Studios, a U.S.-based real estate marketing company that offers brokerages and agents digital solutions to promote and sell properties. This transaction brings together VHT Studios’ visual media services with the immersive Matterport 3D Digital Twin platform to elevate the buying experience for home buyers while simplifying the process of creating comprehensive marketing packages for brokers and agents.

Launched the all-new Matterport Pro3 Camera, a breakthrough in 3D capture technology, along with major updates to its industry-leading digital twin cloud platform. The Matterport Pro3 Camera is one of the most advanced Matterport 3D capture devices with a powerful combination of sensors working in harmony to create stunning digital twins, both indoors and outdoors.

Matterport expanded its presence in the North American market with a new relationship with TD SYNNEX, a leading distributor and IT solution aggregator, to integrate Matterport’s 3D digital twin platform across TD SYNNEX’s network of 150,000 resellers.

Partnered with Burns & McDonnell, an engineering, construction and architecture firm providing services for critical infrastructure companies with more than 10,000 employees, to deliver the Matterport Digital Twin Platform, including software services and hardware, to optimize construction expansion and maintenance projects.

Partnered with North Carolina Regional MLS, one of the largest Multiple Listing Services in North Carolina, covering more than half of the state and, representing nearly 12,000 realtors and appraisers, to integrate the Matterport Digital Twin Platform with its new listing management system, BrokerBay.

Collaborated with Emmy Award-winning creative director David Korins and hyperrealist artist Robin Eley, to create an immersive 3D experience of their limited-run exhibition in New York City, Private Collection/Closed for Installation.

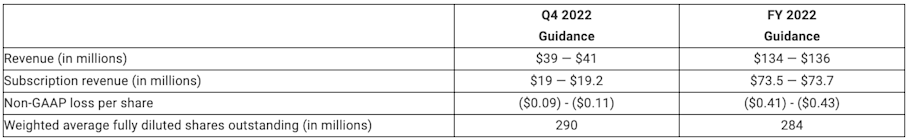

Fourth Quarter and Full Year 2022 Out**look**

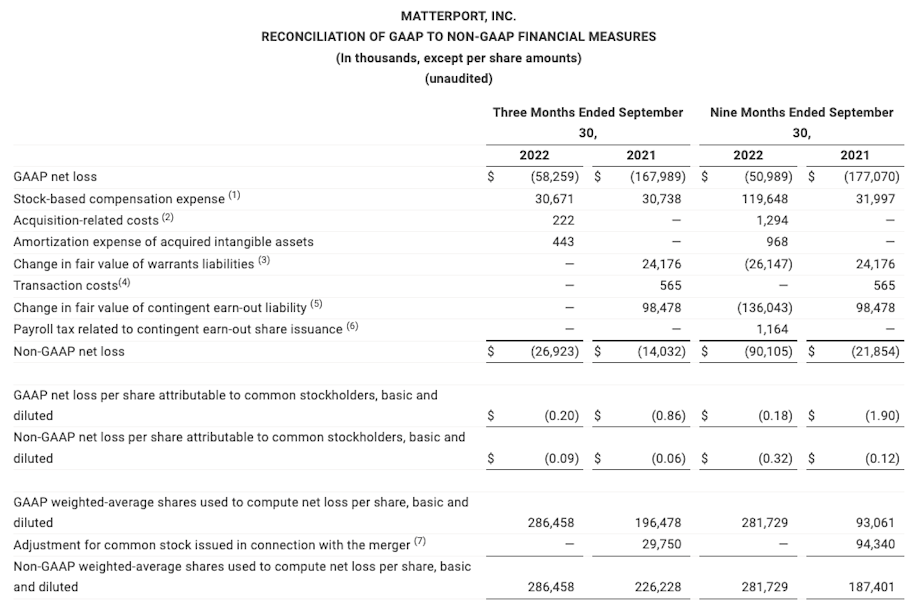

Non-GAAP Financial Information

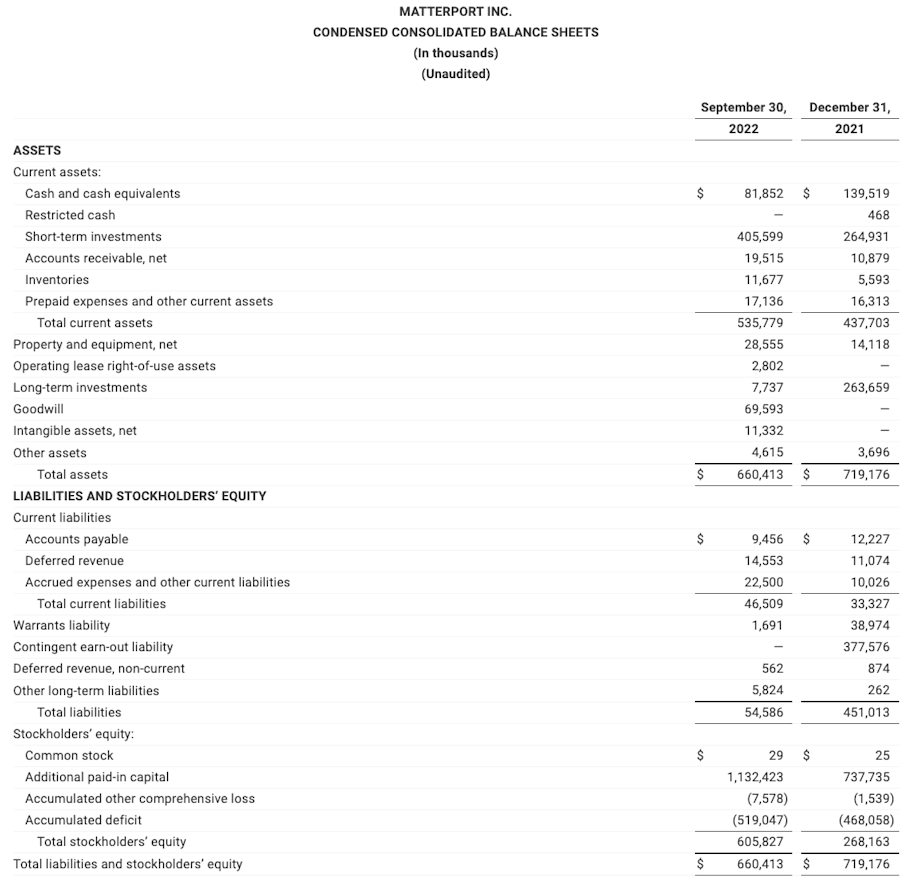

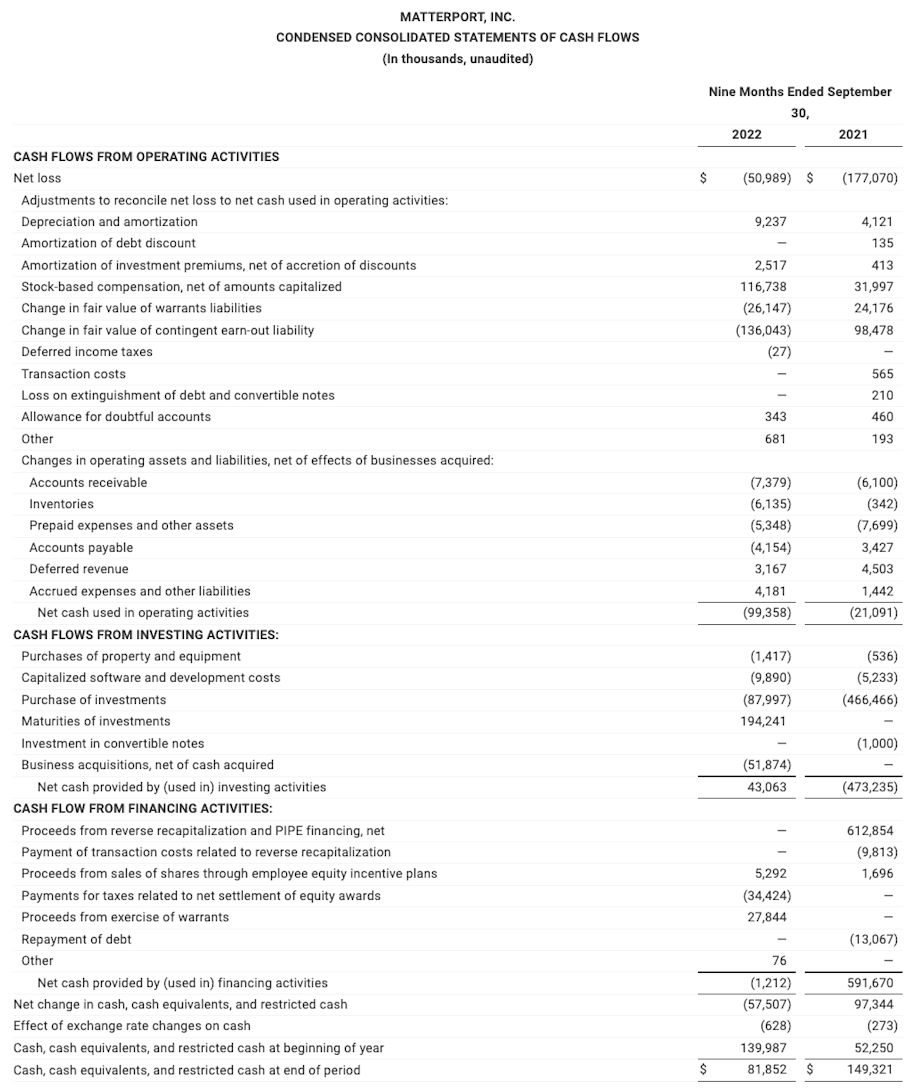

Matterport has provided in this press release financial information that has not been prepared in accordance with generally accepted accounting principles in the United States (GAAP). We believe that the presentation of non-GAAP financial information provides important supplemental information to management and investors regarding financial and business trends relating to Matterport’s financial condition and results of operations.

The presentation of these non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP. For further information regarding these non-GAAP measures, including the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, please refer to the financial tables below.

Non-GAAP Net Loss and Non-GAAP Net Loss Per Share, Basic and Diluted. Matterport defines non-GAAP net loss as net loss, adjusted to exclude stock-based compensation expense, fair value change of warrants liabilities, fair value change of earn-out liabilities, payroll tax related to contingent earn-out share issuance, acquisition-related costs, transaction costs, and amortization of acquired intangible assets, in order to provide investors and management with greater visibility to the underlying performance of Matterport’s recurring core business operations. In order to calculate non-GAAP net loss per share, basic and diluted, Matterport uses a non-GAAP weighted-average share count. Matterport defines non-GAAP weighted-average shares used to compute non-GAAP net loss per share, basic and diluted, as GAAP weighted average shares used to compute net loss per share attributable to common stockholders, basic and diluted, adjusted to reflect the shares of Matterport’s Class A common stock exchanged for the previously issued and outstanding shares of redeemable convertible preferred stock and common stock warrants of Matterport, Inc. (now known as Matterport Operating, LLC) in connection with the recently completed merger, that are outstanding as of the end of the period as if they were outstanding as of the beginning of the period for comparability.

Conference Call Information

Matterport will host a conference call for analysts and investors to discuss its financial results for the third quarter of fiscal 2022 today at 1:30 p.m. Pacific time (4:30 p.m. Eastern time). A recorded webcast of the event will also be available following the call for one year on the Matterport’s Investor Relations website at investors.matterport.com. The dial-in number will be (412) 902-4209, conference ID: 10171665.

The financial results press release and a live webcast of the conference call will be accessible from the Matterport website at investors.matterport.com. An audio webcast replay of the conference call will also be available for one year at investors.matterport.com.

About Matterport

Matterport, Inc. (Nasdaq: MTTR) is leading the digital transformation of the built world. Our groundbreaking spatial data platform turns buildings into data to make nearly every space more valuable and accessible. Millions of buildings in more than 177 countries have been transformed into immersive Matterport digital twins to improve every part of the building lifecycle from planning, construction, and operations to documentation, appraisal and marketing. Learn more at matterport.com and browse a gallery of digital twins.

©2022 Matterport, Inc. All rights reserved. Matterport is a registered trademark and the Matterport logo is a trademark of Matterport, Inc. All other marks are the property of their respective owners.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding the services offered by Matterport, Inc. and the markets in which Matterport operates, business strategies, debt levels, industry environment including relating to the global supply chain, potential growth opportunities, the effects of regulations and Matterport’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “forecast,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions (including the negative versions of such words or expressions).

Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including our ability to grow market share in our existing markets or any new markets we may enter; our ability to respond to general economic conditions; our ability to manage our growth effectively; our success in retaining or recruiting our officers, key employees or directors, or changes required in the retention or recruitment of our officers, key employees or directors; the impact of the regulatory environment and complexities with compliance related to such environment; our ability to remediate our material weaknesses; factors relating to our business, operations and financial performance, including: the impact of the ongoing COVID-19 public health emergency or other infectious diseases, health epidemics and pandemics; our ability to maintain an effective system of internal controls over financial reporting; our ability to achieve and maintain profitability in the future; our ability to access sources of capital; our ability to maintain and enhance our products and brand, and to attract customers; our ability to manage, develop and refine our technology platform; the success of our strategic relationships with third parties; our history of losses and whether we will continue to incur continuing losses for the foreseeable future; our ability to protect and enforce our intellectual property rights; our ability to implement business plans, forecasts, and other expectations and identify and realize additional opportunities; our ability to attract and retain new subscribers; the size of the total addressable market for our products and services; the continued adoption of spatial data; any inability to complete acquisitions and integrate acquired businesses; general economic uncertainty and the effect of general economic conditions in our industry; environmental uncertainties and risks related to adverse weather conditions and natural disasters; the volatility of the market price and liquidity of our Class A common stock and other securities; the increasingly competitive environment in which we operate; and other factors detailed under the section entitled “Risk Factors” in our Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in documents filed by Matterport from time to time with the U.S. Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Matterport assumes no obligation and, except as required by law, does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Matterport does not give any assurance that it will achieve its expectations.

Investor Contact:Lindsay SavareseInvestor Relations[email protected]

Media Contact:Steve Lombardi[email protected]

(1) Consists primarily of non-cash share-based compensation related to the Company's stock incentive plans and earn-out arrangement.

(2) Consists of acquisition transaction costs.

(3) Consists of the non-cash fair value measurement change for public and private warrants.

(4) Consists of the transaction costs associated with warrants instrument issuance

(5) Represents the non-cash fair-value measurement change related to our earn-out liability.

(6) Represents the payroll tax related to Earn-out shares issuance and release.

(7) Consists of non-GAAP adjustment of unweighted average common stock issued and converted from Matterport, Inc.’s (now known as Matterport Operating, LLC) previously issued and outstanding shares of convertible preferred stock and common stock warrants prior to the completion of the merger.