Matterport Announces Record Quarterly Financial Results

Matterport Reports Revenue of $27 Million, an Increase of 108% Year over Year, While Subscriber Growth Jumps 531% to 331,000

SUNNYVALE, Calif. — Matterport, Inc., the leading spatial data company driving the digital transformation of the built world, today announced financial results for the quarter ended March 31, 2021. In February 2021, Matterport announced that it has entered into a definitive agreement to enter into a business combination with Gores Holdings VI (NASDAQ: GHVI, GHVIU, and GHVIW), a special purpose acquisition company sponsored by an affiliate of The Gores Group, LLC, that will result in Matterport becoming a publicly listed company. Upon closing of the proposed business combination, the combined company will be named “Matterport, Inc.” and intends to remain listed on NASDAQ under the ticker symbol “MTTR.”

Q1 Financial and Operational Highlights:

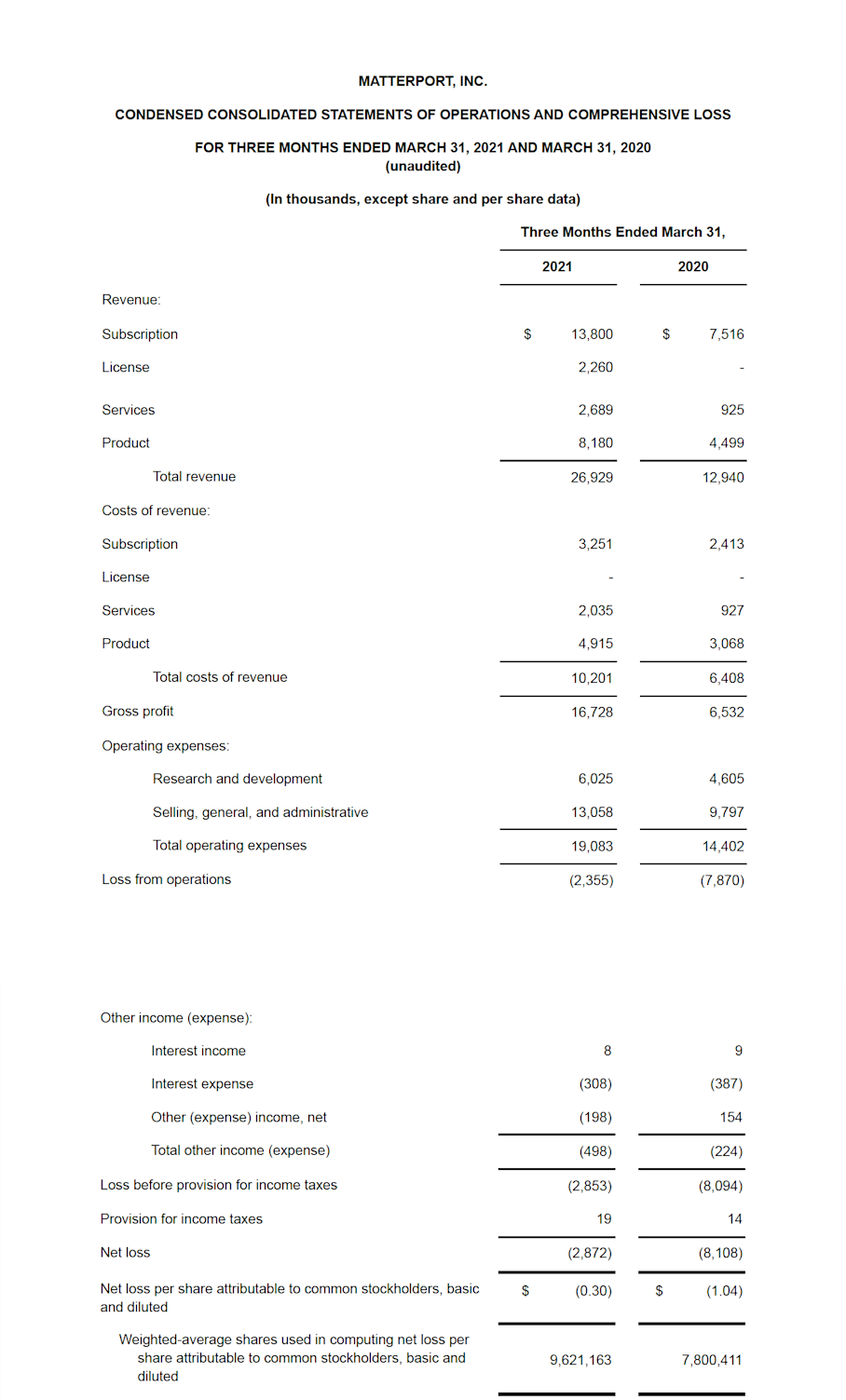

Total revenue was $26.9 million, up 108% year over year

Subscriber revenue of $13.8 million, up 84% year over year

Annual Recurring Revenue (ARR) of $55.2 million

Spaces Under Management (SUM) grew to 4.9 million, up 88% from a year ago, surpassing 5 million in April

Subscribers increased to 331,000, up 531% year over year

Broadened market reach with the release of Matterport Capture app on Android

Added LiDAR Support to Matterport for iPhone to capitalize on Apple's new depth sensor and increase the fidelity and accuracy of Matterport digital twins

Increased the capabilities of Capture Services™, our online services platform that delivers a convenient turnkey solution for enterprises seeking to rapidly scale the digitization of their global real estate assets

Expanded into South Africa and the Middle East by establishing relationships with key value-added resellers

Invested for growth by increasing total headcount by more than 20% from a year ago.

Recent key leadership hires include VP of Solutions Engineering, VP of Customer Operations, VP of Investor Relations, and VP of International Marketing.

In February, announced a definitive agreement to enter into a business combination with Gores Holdings VI (NASDAQ: GHVI, GHVIU, and GHVIW), and in April, Gores Holdings VI filed a Registration Statement on Form S-4 relating to the transaction

“We are pleased to report another record quarter, with revenue more than doubling from the same period a year ago. As demand to digitize the built world continues to rise, our subscriber base has increased exponentially, bolstered by big advances across our iPhone, Android, and Enterprise platform and service offerings,” said RJ Pittman, Chief Executive Officer of Matterport. “This quarter once again reflects our enduring, strong execution – across product innovation, expanding service offerings, extended global reach, and most importantly, adding to our world-class talent base. We have also made excellent progress on our proposed merger with Gores Holdings VI, and the closing is on track for early in the third quarter. This transaction enables Matterport to more aggressively achieve significant global scale as a public company. Matterport has been digitizing the built world for a decade and we are very well-positioned to capitalize on this enormous opportunity in front of us,” Pittman added.

“Our Q1 financial results show continued positive momentum in our business, as we delivered records in total revenue, subscription revenue, and annual recurring revenue,” said JD Fay, CFO of Matterport. “Not only are we rapidly adding new subscribers, our existing subscribers are also increasing their spend with us and seeing more value as they expand the use of our products. Further, we believe our innovation in digitizing the built world will continue to support strong future growth.”

For additional details regarding Matterport’s results, please see the Earnings Presentation on the investor relations page of our website at: https://matterport.com/investors

About Matterport

Matterport is leading the digital transformation of the built world. Our groundbreaking spatial computing platform turns buildings into data making every space more valuable and accessible. Millions of buildings in more than 150 countries have been transformed into immersive Matterport digital twins to improve every part of the building lifecycle from planning, construction, and operations to documentation, appraisal and marketing. Learn more at matterport.com and browse a gallery of digital twins.

©2021 Matterport, Inc. All rights reserved. Matterport is a registered trademark and the

Matterport logo is a trademark of Matterport, Inc. All other marks are the property of their respective owners.

Investor Contact: Soohwan Kim, CFAVP, Investor Relations [email protected]

Media Contact: Naomi Little Global Communications Manager [email protected] +44 203 874 6664

Forward-Looking Statements

This document contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed business combination between Gores Holdings VI, Inc. (“Gores”) and Matterport, Inc. (“Matterport”), including statements regarding the benefits of the proposed business combination, the anticipated timing of the proposed business combination, the services offered by Matterport and the markets in which Matterport operates, business strategies, debt levels, industry environment, potential growth opportunities, the effects of regulations and Gores’ or Matterport’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “forecast,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions (including the negative versions of such words or expressions).

Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the proposed business combination may not be completed in a timely manner or at all, which may adversely affect the price of Gores’ securities; (ii) the risk that the proposed business combination may not be completed by Gores’ business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Gores; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval of the proposed business combination by Gores’ stockholders, the satisfaction of the minimum trust account amount following redemptions by Gores’ public stockholders and the receipt of certain governmental and regulatory approvals; (iv) the effect of the announcement or pendency of the proposed business combination on Matterport’s business relationships, performance, and business generally; (v) risks that the proposed business combination disrupts current plans of Matterport and potential difficulties in Matterport employee retention as a result of the proposed business combination; (vi) the outcome of any legal proceedings that may be instituted against Gores or Matterport related to the agreement and plan of merger or the proposed business combination; (vii) the ability to maintain the listing of Gores’ securities on the NASDAQ; (viii) the price of Gores’ securities, including volatility resulting from changes in the competitive and highly regulated industries in which Matterport plans to operate, variations in performance across competitors, changes in laws and regulations affecting Matterport’s business and changes in the combined capital structure; and (ix) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in Gores final proxy statement/information statement/prospectus contained in the registration statement on Form S-4, including those under “Risk Factors” therein, and other documents filed by Gores from time to time with the U.S. Securities and Exchange Commission (the “SEC”). These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Gores and Matterport assume no obligation and, except as required by law, do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Gores nor Matterport gives any assurance that either Gores or Matterport will achieve its expectations.

Additional Information and Where to Find It

In connection with the proposed business combination, Gores has filed a registration statement on Form S-4 that includes a proxy statement of Gores, an information statement of Matterport and a prospectus of Gores. The proxy statement/information statement/prospectus is not yet effective. The definitive proxy statement/information statement/prospectus, when it is declared effective by the SEC, will be sent to all Gores and Matterport stockholders as of a record date to be established for voting on the proposed business combination and the other matters to be voted upon at a meeting of Gores’ stockholders to be held to approve the proposed business combination and other matters (the “Special Meeting”). Gores may also file other documents regarding the proposed business combination with the SEC. The definitive proxy statement/information statement/prospectus will contain important information about the proposed business combination and the other matters to be voted upon at the Special Meeting and is not intended to provide the basis for any investment decision or any other decision in respect of such matters. Before making any voting decision, investors and security holders of Gores and Matterport are urged to read the registration statement, the proxy statement/information statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed business combination as they become available because they will contain important information about the proposed business combination.

Investors and security holders will be able to obtain free copies of the proxy statement/information statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Gores through the website maintained by the SEC at www.sec.gov, or by directing a request to Gores Holdings VI, Inc., 6260 Lookout Road, Boulder, CO 80301, attention: Jennifer Kwon Chou or by contacting Morrow Sodali LLC, Gores’ proxy solicitor, for help, toll-free at (800) 662-5200 (banks and brokers can call collect at (203) 658-9400).

Participants in Solicitation

Gores and Matterport and their respective directors and officers may be deemed to be participants in the solicitation of proxies from Gores’ stockholders in connection with the proposed business combination. Information about Gores’ directors and executive officers and their ownership of Gores’ securities is set forth in Gores’ filings with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the proxy statement/information statement/prospectus regarding the proposed business combination. You may obtain free copies of these documents as described in the preceding paragraph.

Disclaimer

This document relates to a proposed business combination between Gores and Matterport. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.