How Digital Twins Define the Future of Property Insurance & Restoration

When it comes time to pay bills each month, property owners often write their first check for the mortgage or lease, and the second is reserved for insurance to protect their assets. So, it’s no surprise the casualty and property insurance market is projected to reach $3.795 trillion by 2032. And technological advancements have driven much of the market's growth.

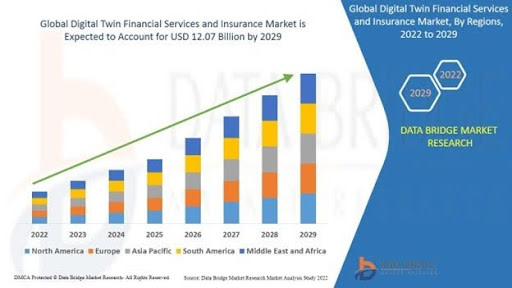

One of the innovations moving the insurance industry forward is digital twin technology. These three-dimensional virtual replicas of properties help insurers streamline the claims process, identify potential fraud, and more accurately assess risk. It’s this wealth of benefits that’s led to digital twins in the financial services and insurance market having an anticipated value of over $12 billion by 2029.

Below, learn how property insurance companies are leveraging digital twins and how the technology helps tackle common challenges.

How digital twins are transforming the way companies handle insurance claims

Digital twin technology is positively disrupting property insurance processes by accelerating the ability of all parties involved to agree on the physical aspects of what’s under review to speed up the entire claims process.

Some of the other key benefits include:

Improved documentation

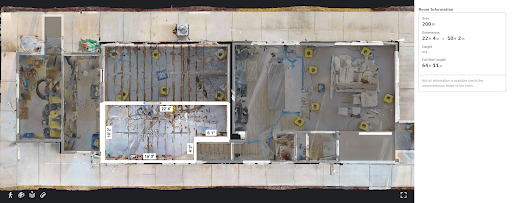

True-to-life digital twins help estimators quickly build thorough, accurate records of damages and efficiently manage insurance documents. Virtual replicas memorialize the scene of a damaged property and provide immersive evidence for claims. A single scan not only creates a 3D replica of a space—a digital twin auto-generates exact measurements of the space. It can be exported as a schematic floor plan, and reviewers can add digital tags to supply video/audio/written files and notes.

Secure, compliant records

Digital twins comply with many states’ confidentiality requirements, so they’re court-admissible for litigation. For example, Matterport 3D models can blur faces and remove personally identifiable information (PII). The platform also secures metadata and time-stamps photos to prevent manipulation.

More transparent collaboration

It’s simple to share 3D models with risk engineers, adjusters, insurance carriers, and policyholders via a direct link to a digital twin. When all stakeholders can virtually walk through a property, it’s also simple to answer questions and resolve issues more efficiently (and from anywhere).

How digital twins mitigate property insurance risks

The benefits of leveraging digital twins for property insurance go beyond streamlining claims. These virtual versions of properties also work as innovative mitigation tactics for common risks for insurance companies.

Data accuracy and integrity

Property insurance is a data-centric industry. Insurers use a variety of data sets, data sources, and historical data to try to precisely understand current and future risks—and what to charge customers for premiums as a result. So, the better the data, the better the decision-making.

However, sifting through mountains of information isn’t the best way for insurers to spend their time. A quick scan to capture a home or commercial property provides accurate measurements of the space, sketches including schematic floor plans, a video walkthrough, and a virtual tour. And it’s simple to save crucial measurements, notes, and other data right in the 3D model to centralize important info.

More accurate and centralized data makes it easier for property insurance companies to make faster, more informed decisions on claims—which translates to higher customer satisfaction.

Cybersecurity concerns

Property insurance companies manage sensitive data—specifically PII like full names, addresses, and so on. So, insurers must have strong security measures in place to protect clients’ info from data breaches. Companies have to meet standards for data quality, format, and consistency. The same applies to any tech tools insurers use. Fortunately, Matterport digital twins offer insurers all the advantages above while maintaining compliance with secure data protocols. For example, Matterport digital twins comply with the confidentiality requirements for many U.S. states. Carriers can blur faces, remove PII, secure metadata, and time-stamp imagery and measurements so they can’t be manipulated. Because of these security features, Matterport’s 3D models are court-admissible documentation.

Expensive and time-consuming site visits

One of the most time-consuming and costly tasks for property insurance companies is site visits—from property inspections for new policies to multiple site visits to assess damages for a claim. Adjusters and restoration pros insurance companies hire often spend hours manually measuring spaces and creating documentation on-site. And more time spent in the field typically translates to higher costs and longer delays for claims approvals.

Matterport Property Intelligence transforms the site visit and estimations process, allowing contractors to quickly and safely obtain precise measurements, detailed floor plans, and comprehensive property reports with just a few clicks. This technology enhances their workflow, ensuring both accuracy and efficiency while eliminating the need for costly revisits and revisions.

Legal and ethical considerations

Property insurance carriers have to wade through a variety of legal and ethical considerations day-to-day. For example, according to the FBI, there’s a total of $40 billion a year in insurance fraud (not including health insurance). And policyholders literally pay the price for this fraud through higher premiums.

As a result, one of the most time-consuming legal activities insurance companies face is detecting any fraudulent activities. Fortunately, digital twins make it easy for companies to verify damage to a property due to floods, fires, and so on. This makes it simpler to identify inconsistent claims and prevent insurance fraud.

Why digital twins are the future of property insurance for restoration and disaster recovery

When digital twins are combined with a robust ecosystem of tools, the technology can help property insurance companies move forward in their digital transformation and handle insurance restoration and natural disaster claims.

Matterport’s 3D scans for insurance and restorations make it simple for pros to create accurate, fair insurance documents and valuations while also cutting costs, saving time, and speeding up claim approvals. And here’s how.

Prompt repair estimates

Time is critical for restoration pros and the customers they’re serving—particularly when property damage is the result of a disaster. The goal is to get customers back in their homes as quickly as possible. So, accelerating the estimate process can lead to faster resolution and repairs.

Fortunately, 3D digital twins can move repair estimates forward faster. For example, California software firm mpartial relies on Matterport to turn around prompt reconstruction and repair estimates for buildings damaged by floods, earthquakes, windstorms, and fires.

mpartial leverages Matterport’s suite of tools—digital twins, an API, an SDK, and more—to help contractors generate prompt and accurate estimates. Ultimately, these features unloaded a lot of time-consuming admin tasks via automation and led to faster approvals.

As a result of leaning on Matterport, mpartial saw a 300% spike in productivity, automated 80% of their tedious repetitive tasks, cut down on litigation, and sped up the claims process.

Improved accuracy for documentation across the insurance cycle

Getting thorough documentation during all stages of the claims process is critical. More comprehensive records and notes not only benefit insurance carriers, but also forensics pros, restoration companies, and home and business owners.

Thorough documents prevent discrepancies and delays due to resolving issues. Fortunately, digital twins make it simple to create comprehensive, centralized documentation that can easily be shared via a link with all stakeholders in the process.

Increased accuracy in documentation is exactly what restoration firm ATI Restoration needed when they teamed up with Matterport. Prior to using Matterport, estimators spent hours measuring damaged spaces with laser or tape measures and leveraging basic photography. They then had to load those photos and measurements into to create diagrams to load into Xactimate Sketch—software that generates property loss statements, estimates the costs of repairs, and creates claim offers.

But now, ATI leans on Matterport’s TruePlan for Xactimate for accurate measurements and to generate fast, accurate documentation. Thanks to Matterport’s 3D digital twins and TruePlan, ATI increased their measurement accuracy from 87-90% to 97.5-99%, boosted their sketch productivity fivefold, and curbed the need for additional site visits and all the expenses that come with travel.

ATI saves about three-and-a-half workdays measuring and sketching a 30,000-square-foot property with TruePlan. When scaled to 10 similar projects, the time savings increase to a whopping 32 working days.

Fewer costly site visits

As aforementioned, using high-tech tools across the insurance claims cycle helps move the entire process along with fewer hiccups and delays. One way to reduce lag is to cut down on the number of time-consuming site visits.

Florida-based restoration firm Master Restoration found this to be the case when they adopted Matterport’s 3D digital twins to reshape their estimating processes. Previously, the company dispatched workers to damaged properties to document conditions, take manual measurements, and snap photos. And because of the high volume of properties, estimators typically took another 2-3 days after a site visit to write up the estimate.

Unfortunately, project managers, estimators, and insurance adjustors had to make additional site visits for 12% of cases because of incomplete notes or missing information. Everyone from insurance adjusters to contractors, to homeowners was flustered with this lengthy process.

Now, Master Restoration uses Matterport on the first site visit to capture a 3D scan of the damaged property. This virtual version of the site eliminated the need to return to properties and improved the turnaround on estimates as a result.

Thanks to Matterport, Master Restoration sped up estimates by 20% and reduced the average time to settle with insurance carriers by 37%.

Learn more about how Matterport can transform the insurance claim and restoration process >>

Have additional questions about how digital twins and property insurance? Take a look at the commonly asked queries below.